Emergency loans from financial bodies not to solve Pakistan's woes, need to diversify its economic policies

ANI

23 Sep 2022, 19:25 GMT+10

Islamabad [Pakistan], September 23 (ANI): Pakistan needs an overhaul of economic policy as the country is facing its worst ever floods in history accompanied by a huge resource gap despite getting emergency loans from global financial bodies for the reconstruction.

The pressure of the resource gap is mounting as Pakistan is unable to seek foreign aid or loans due to its non-performing economy with slow growth, twin deficits, shrinking foreign exchange and uncontrolled inflation, reported Financial post.

Due to poor macroeconomic indicators, its sovereign credit rating has slipped to non-investment grade. Citing Pakistan's weakening economic condition, Moody's, Fitch, and SP Global - all major global rating agencies - downgraded Pakistan's long-term rating from stable to negative in July. These agencies had also highlighted the country's weakening external position, higher commodity prices, rupee depreciation and tighter global market conditions.

It is evident from the recent disclosure of Finance Minister Miftah Ismail stating that "none of the friendly countries is ready to financially support Pakistan" because it "has an imbalanced economy".

Recently, Pakistan got restored the IMF's Extended Fund Facility (EFF) and the World Bank's intent of clubbing two of its policy loans over USD 1 billion and the Asian Development Bank's (ADB) indication to provide approximately USD 1.5 billion emergency loans.

The problem has in fact prompted the Pak Government to levy an unpopular super tax with three rates Rs 3000/-, Rs 5000/- and Rs 10,000/- to collect Rs 41 billion tax from shopkeepers and an additional tax of 5 per cent on manufacturers having zero contribution to exports, reported Financial Post, reported Financial Post.

The decision of the IMF to extend EFF to the end-June 2023 and re-phasing and augmentation bringing the EFF to USD 6.5 billion would give only temporary relief. The 7th and 8th tranches would release about USD 1.17 billion under EFF for Pakistan.

Islamabad is experiencing huge differences between imports and exports. And despite recent measures taken to ban the import of various items, Pak imports continue to rise.

While policymakers in Islamabad are firefighting to manage the economy in the aftermath of catastrophic floods, the funds arranged by the IMF to avert a default in foreign debt are also causing a lot of pressure on the economy due to stringent conditionality on the country which has seen very fragile growth during COVID-19 period and accumulated unsustainable debt and current account deficit over time, reported Financial Post.

Moreover, the IMF conditionality includes hiking power tariffs, imposing a levy on petroleum, higher revenue mobilization and restraining expenditure to reduce the fiscal deficit, continued adherence to market-determined exchange rate and setting up an anti-corruption task force to curb graft in government departments.

Further, Pakistan is unable to boost its exports to overcome its ever-belonging trade deficit. Due to a lack of diversification and value addition, many industries could not contribute to the country's export basket but kept on importing raw materials to cater to internal markets, reported Financial Post.

For increasing exports, Pakistan needs to focus on its comparative advantage and collaboration with foreign companies which could help industrial growth through technology transfer as well as providing capital for industrialization. Just relying on China has not helped much and would not do well even in future.

Pakistan is also facing other pressures. The Power Purchasing Agreements (PPA) of the China-Pakistan Economic Corridor (CPEC) is a contentious issue between Pakistan, China and the IMF and the main condition is to "reduce circular debt flow through reducing power generation costs and retargeting electricity subsidies".

Pakistan cannot achieve macroeconomic stability until its power sector is fixed. The IMF has also flagged the abrupt growth slowdown in China as a major concern as its financial elbow room leverage, a key strategic partner, is shrinking, reported Financial Post. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Baton Rouge Post news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Baton Rouge Post.

More InformationBusiness

SectionSaudi Aramco plans asset sales to raise billions, say sources

DUBAI, U.A.E.: Saudi Aramco is exploring asset sales as part of a broader push to unlock capital, with gas-fired power plants among...

Russia among 4 systemic risk countries for Italian banks

MILAN, Italy: Italian regulators have flagged four non-EU countries—including Russia—as carrying systemic financial risk for domestic...

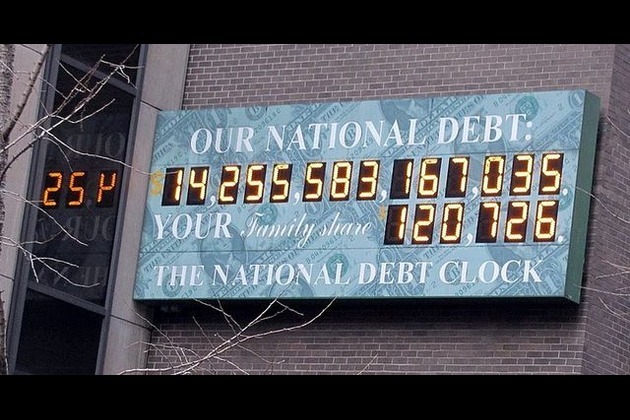

US debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Shein hit with 40 million euro fine in France over deceptive discounts

PARIS, France: Fast-fashion giant Shein has been fined 40 million euros by France's antitrust authority over deceptive discount practices...

Meta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

World

SectionUS debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

China opposes tariff wars, coercion after Trump's threat to BRICS countries

Beijing [China], July 7 (ANI): China on Monday responded to US President Donald Trump's threat of imposing an additional 10 per cent...

Indian markets hold steady, close flat amid US tariff uncertainty

Mumbai (Maharashtra) [India], July 7 (ANI): Indian stock benchmarks closed their first day of the week with slight gains, as investors...

Pakistan: PTI slams perk hike for Punjab ministers amid public crisis

Lahore [Pakistan], July 7 (ANI): The Pakistan Tehreek-i-Insaf (PTI) has strongly condemned the recent increase in privileges for the...

Tadweer Group joins United Nations Global Compact

ABU DHABI, 7th July 2025 (WAM) -- Tadweer Group, the sole authority for waste management in the Emirate of Abu Dhabi and a subsidiary...

Trump calls Texas floods a '100-year catastrophe', says Gaza deal likely this week

(New Jersey) [US], July 7 (ANI): US President Donald Trump on Sunday (local time) described the floods in Texas as a '100-year catastrophe'...